Blog

Market Research Methods

Table of Contents

- Why Market Research Matters

- Core Market Research Types

- Qualitative And Quantitative Methods

- Research Design And Execution

- Advanced Sampling And Analysis

- Common Market Research Questions

- Key Takeaways And Next Steps

Why Market Research Matters

What Market Research Means

Market research methods gather and analyze data on consumers, competitors, and markets. It reveals objective truths. Understanding customers and competitors is paramount. Ignoring this guarantees obsolescence.

Why It Matters Locally

For local businesses, local market research secures ultimate advantage. Pinpoint target audience needs, optimizing local SEO. Ignoring local nuances loses customers to savvier competitors. Dominate your local SEO landscape.

Primary vs Secondary Research

Compare primary and secondary research for optimal starting points.

| Attribute | Primary Research | Secondary Research |

|---|---|---|

| Definition | Surveys, interviews, observations designed to answer unique business needs. | Existing reports, industry data, competitor materials used for context. |

| Cost | Higher due to data collection and incentives. | Lower; uses already published data and reports. |

| Speed | Slower because of design and fieldwork time. | Faster; data is immediately available for analysis. |

| Best Use | Testing new offerings or local customer preferences. | Market sizing and trend spotting from published sources. |

Key Terms To Know

Terminology defines approach. Target audience refers to who you serve. Sampling dictates data collection reach. Qualitative explores the “why.” Quantitative measures “how much.” Primary research collects bespoke insights, secondary research leverages public intelligence. Data validity proves findings concrete, not conjecture.

Core Market Research Types

Ignoring the fundamental categories of market research methods is a rookie error. You cannot effectively strategize without knowing the differences. This isn’t academic debate, it’s about making money.

Primary Research

Primary research is your direct line to truth. You collect original data specifically for your questions. Forget relying on outdated reports, this is bespoke intelligence. Think surveys, interviews, focus groups, and direct observational research. It uncovers unique local preferences that external reports simply cannot replicate. Relying on generic, syndicated data for local strategy is marketing suicide. The cost is higher. The insights are priceless.

Secondary Research

Secondary research, the forgotten goldmine. This uses existing data already collected by others. Industry reports, public government data, academic studies, and competitor methods are your starting points. It is faster. It is cheaper. But never mistake convenience for specificity. You must evaluate the quality ruthlessly. Is it relevant to your local market? Is it current? Most importantly, does it actually help you beat your local rivals that are already winning local visibility? The market does not forgive ignorance.

Qualitative Methods

Qualitative research delves into the why. Forget numbers. This method extracts rich, non-numeric data through interviews and focus groups. Its purpose: understanding motivations, perceptions, and underlying thoughts. The analysis often uses thematic coding, identifying patterns in subjective responses. This is where real customer insights reside. This is where you uncover the emotional triggers that drive purchases, not just the purchase itself.

Quantitative Methods

Quantitative research is about the what and the how much. It uses numerical data to measure, quantify, and generalize. Surveys and experiments are standard tools. Achieving statistical validity means large samples and precise measurements. This isn’t about opinions. This is about verifiable facts: market share, feature preferences, price sensitivity. Anyone who tells you otherwise is selling you fairy tales.

Qualitative vs Quantitative

Side-by-side overview to illustrate differences and when to use each approach.

| Aspect | Qualitative | Quantitative |

|---|---|---|

| Goal | Explore perceptions and motivations. Depth of insight from interviews, focus groups. | Measure frequency and correlation at scale. |

| Data Type | Narrative data, open responses. | Numbers, ratings, counts. |

| Sample Size | 20–50 participants often sufficient. | Large samples required for significance. |

| Analysis | Coding and pattern identification. | Statistical testing and modelling. |

Qualitative And Quantitative Methods

Moving beyond basic definitions, mastering execution is key. Your choices here dictate the value of your data and your eventual market positioning. This is where hypotheses become hard facts or abject failures.

Survey Design Principles

Designing effective surveys is more art than science, yet governed by strict rules. Question wording must be unambiguous, avoiding bias at all costs. Scales need consistency. Are you using a Likert scale or a semantic differential? Choose consciously, not arbitrarily. Pilot testing your questionnaire is non-negotiable. Leverage online panels for reach or tap your existing local customer lists for deeper fidelity. Response rates are everything. A 10% response on a poorly designed survey tells you nothing. A 30% response from satisfied local customers tells you everything. You must demand clarity from your questions and integrity from your respondents.

Focus Groups And Interviews

Focus groups and interviews are not casual conversations; they are structured intelligence gathering missions. Recruitment targets specific demographics and psychographics of your target audience. Moderation requires skill, preventing dominant voices from skewing results. Develop discussion guides that prod, challenge, and explore, not just confirm. Transcripts demand rigorous analysis; look for themes, contradictions, and unexpected insights. Did 80% of your participants say they love your product, but their body language screamed indifference? Trust the latter. The real data often hides beneath the surface, waiting for a persistent researcher.

Observational Research

Observational research cuts through stated preferences, revealing actual behavior. What people say and what they do are two different things. This method involves watching, listening, and recording interactions in natural settings, both in-person and remotely. Ethical considerations are paramount: privacy, informed consent, and anonymity are non-negotiable. Track actions, gestures, usage patterns. Are customers struggling to find specific items in your store? Are they abandoning carts online due to a clunky checkout process? This unvarnished feedback is what drives tangible improvements, not mere theoretical discussions. You must observe the truth.

Social Listening And Analytics

Social listening and analytics provide a constantly flowing stream of unsolicited customer feedback. This isn’t just about counting likes or shares. It’s about discerning sentiment, identifying pain points, and tracking emerging trends related to your brand. Use advanced tools to monitor online conversations. Integrate web analytics to see user journeys. Brand monitoring exposes what the market truly thinks, unfiltered and in real-time. This digital research augments traditional methods, validating findings and revealing new avenues for exploration. You miss critical shifts if you ignore the digital chatter.

Survey Platforms Comparison

Compare common survey approaches for local businesses evaluating cost, speed, and reliability.

| Approach | Speed | Reliability |

|---|---|---|

| Online Panels | High — rapid responses within days. | Moderate; depends on panel quality. |

| Customer Email Surveys | Medium — depends on response rate. | High for engaged customers, biased for loyal segments. |

| In-Person Surveys | Slow — time to arrange and fieldwork. | High when sampling is controlled. |

| Social Listening Tools | Real-time to near real-time. | Variable; needs careful validation. |

Research Design And Execution

Execution separates the strategists from the daydreamers. Flawed design guarantees flawed results. This is where you transform abstract ideas into actionable intelligence.

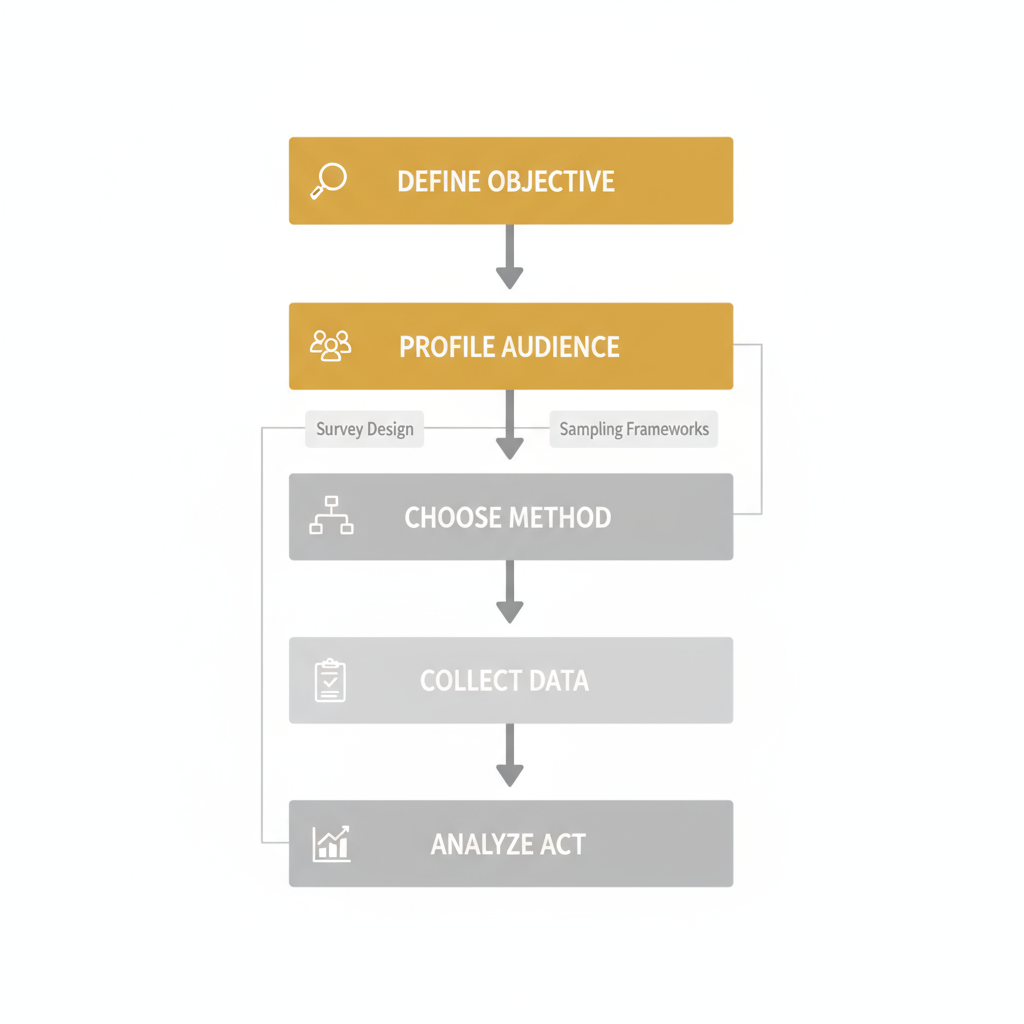

Defining Your Target Audience

You cannot hit a target audience you haven’t defined. Profiling customers means moving beyond demographics. Develop personas that capture behaviors, pain points, and aspirations. For local businesses, this means focusing on geographic segments, local intent signals, and community ties. Who frequents that coffee shop? What concerns those families in the adjacent neighborhood? Understanding your target audience with such precision is a competitive weapon. Anything less is a guess. The local shoe store that ignored the Gen Z skateboarding crowd, despite their physical presence nearby, lost $50,000 in monthly sales. You’re either precise or irrelevant. Neglecting this crucial step is why 80% of new product launches fail, despite significant initial investment.

Sampling And Recruitment

Your sample is your entire universe. Choose poorly, and your data is worthless. Probability sampling methods like simple random or stratified ensure representativeness, while non-probability methods offer speed but introduce bias. Sample size calculations are not optional; they dictate statistical power. Recruiting respondents ethically and efficiently means clear communication and respecting privacy. Do not cut corners here. A flawed sample invalidates every subsequent finding. Studies show 70% of local businesses relying on convenience samples received misleading insights, costing them an average of $25,000 in failed promotions. Your reputation is at stake. Furthermore, neglecting proper recruitment can lead to skewed results, making your perfectly executed local campaign utterly ineffective.

Collecting And Managing Data

Data collection is messy. You need robust tools and meticulous workflows to capture, clean, and store your research insights. Privacy considerations are paramount; GDPR and CCPA are not suggestions. Implement strong access controls. Conduct rigorous data quality checks to purge inconsistencies and errors. Ignoring data privacy can lead to multi-million dollar fines, as witnessed by recent FTC penalties against major corporations like Equifax and its $575 million settlement. Garbage in, garbage out. This isn’t just about spreadsheets. It’s about maintaining the integrity of your entire research effort. Your decisions depend on it.

Analyzing And Reporting Results

Raw data means nothing. Its analysis is where insights emerge. Quantitative data demands statistical rigor: regression, correlation, significance testing. Qualitative analysis calls for thematic interpretation and pattern identification. Present findings using clear visualization tips, making complex insights accessible. Communicate compelling narratives to stakeholders. Your report isn’t a dump of numbers. It’s a strategic mandate. Get it wrong, and your research dies on the vine. Failure to transform complex data into digestible, actionable recommendations is a common pitfall, wasting thousands in research spend.

Sampling Methods Comparison

Quick guide to common sampling methods with pros and cons for local studies.

| Method | Best For | Drawbacks |

|---|---|---|

| Simple Random | Estimating population parameters without bias. | Often costly and hard for local segments. |

| Stratified Sampling | Ensuring representation across key subgroups. | Requires reliable subgroup data. |

| Convenience Sampling | Early-stage idea validation with limited budget. | High risk of bias, not generalizable. |

| Snowball Sampling | Hard-to-reach or niche audiences recruitment. | Network bias; limited representativeness. |

Advanced Sampling And Analysis

Basic sampling methods are for novices. Maximizing insight requires advanced techniques. Anything less leaves valuable strategic gaps. You cannot win with incomplete information.

Advanced Sampling Techniques

Quota sampling, multi-stage sampling, and weighting adjustments fundamentally improve data accuracy. Correct for nonresponse bias, especially in local samples. Overlooking a crucial segment is catastrophic. Ignoring sophisticated techniques means accepting data that lies. The market doesn’t care about your convenience.

Predictive Analytics And Modelling

Raw data is historical. Predictive analytics transforms it into a crystal ball. Regression models forecast future sales. Segmentation models pinpoint your most profitable local target audience. Forecasting anticipates local demand shifts, allowing proactive adjustments. You can predict next quarter’s success, not merely react. This isn’t magic. It’s disciplined application of data science for a decisive edge. Companies that don’t deploy predictive analytics are already losing.

Integrating Local SEO Insights

Your market research methods are incomplete without integrating local SEO signals. Consumer behavior from focus groups validates search query trends. Combine research outputs with competitor methods and digital research to prioritize local opportunities. Why invest in a segment if search volume proves no local interest? This fusion provides a holistic view, uncovering hidden demand and optimizing your local digital footprint. Ignoring local SEO in your analysis is financial negligence. It’s your compass for local profitability.

Modelling Techniques Overview

Compare modelling approaches for predictive tasks with typical use cases and data requirements.

| Technique | Use Case | Data Needs |

|---|---|---|

| Linear Regression | Predicting numeric outcomes like sales by campaign. Forecasting and trend analysis. | Clean numeric variables, sufficient sample size. |

| Logistic Regression | Classifying binary outcomes such as purchase vs no purchase. Conversion prediction and targeting. | Balanced classes and explanatory variables. |

| Cluster Analysis | Grouping customers by behavior or demographics. Segmentation for local campaigns. | Multi-dimensional variables and normalization. |

| Time Series Forecasting | Modeling seasonality and trends for local demand. Inventory and staffing forecasts. | Historical time-indexed data with sufficient length. |

Common Market Research Questions

Four Core Methods Explained

Core market research methods include: surveys, interviews, focus groups, observational research. These quantify, explore, reveal dynamics, and capture behavior. Essential, actionable insights.

Types Of Research Overview

Primary research collects new data. Secondary research uses existing sources. Qualitative research explores why; quantitative research measures what. Combine to yield superior insights.

Choosing The Right Method

Match goals, budget, timelines to market research methods. Prioritize your target audience. Use mixed methods for precise, actionable results, instantly. No excuses.

Methods Quick Reference

A concise comparison to help readers quickly identify which method fits common research needs.

| Method | Use Case | Typical Output |

|---|---|---|

| Surveys | Measure attitudes at scale. Customer satisfaction or market sizing. | Numeric scores, cross-tabulations. |

| Interviews | In-depth motivations and barriers. Product development and UX insights. | Thematic insights and quotes. |

| Focus Groups | Group dynamics and reactions. Concept testing and messaging feedback. | Nuanced themes and consensus points. |

| Observation | Actual behavior vs stated intent. Store layout or service flow optimization. | Behavioral logs and coded events. |

Key Takeaways And Next Steps

Forget hope as a strategy. You need actionable intelligence. Prioritize market research methods that directly impact your bottom line. Choose methodologies aligned with undeniable business goals, not academic curiosity or vague trends. Initiate pilot studies for niche market research, iterating rapidly to refine your approach. Integrating findings into your local SEO and marketing plans isn’t optional, it’s a competitive imperative. The market rewards precision with profit. It punishes guesswork with extinction curves. Stop overthinking. Act. Your competitors are already harvesting insights-driven.

Resources

- Market Research Methods – Eloquens

- Market Research Types – Qualtrics

- A Guide To Market Research Methods – Drive Research

- Market Research Methods – Brandwatch

- What Is Market Research – JWU Online

- Intro Market Research Process – Georgia Center

- Business Research Methods – Young Urban Project

- Types Of Market Research – GWI

- AI Driven Local Insights – SEOLocal

- Local Search Marketing – SEOLocal